what is the tax rate in tulsa ok

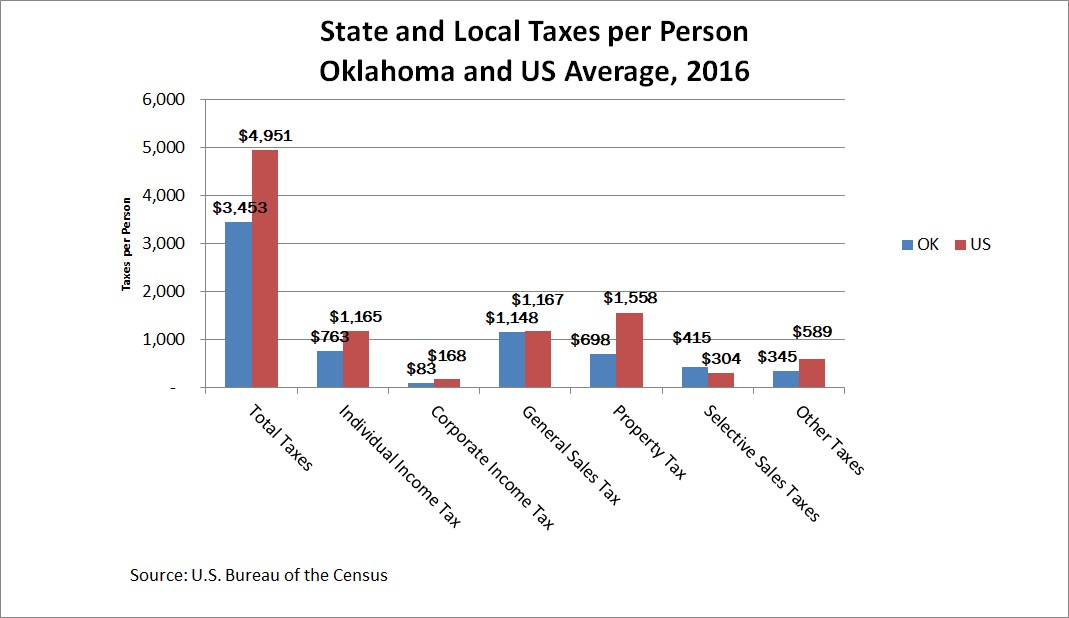

087 average effective rate. Oklahoma State Tax Quick Facts.

How Oklahoma Taxes Compare Oklahoma Policy Institute

How Does Sales Tax in Tulsa compare to the rest of Oklahoma.

. Sales tax at 365 2 to general fund. The total rate in. - The Median household income of a Tulsa resident is 41957 a year.

With local taxes the total sales tax rate. Learn all about Tulsa real estate tax. 31 rows The state sales tax rate in Oklahoma is 4500.

The Tulsa County Sales Tax is 0367. Wright Weighted Averages Skiatook 10468 Skiatook 99 37 Skiatook 11454 to 11539 Sperry 11142 Caney Val 9447 Washington County Collinsville 115139 Owasso 112152 Oologah-Talala 10425182 Collinsville 9921 Owasso 11102 2016 6132 8874 9086 9608 10039. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022.

Wright Tulsa County Assessor. 4 rows The current total local sales tax rate in Tulsa OK is 8517. How far is it from Tulsa OK to Indianapolis IN.

Income and Salaries for Tulsa - The average income of a Tulsa resident is 27313 a year. The Oklahoma sales tax rate is currently. The current total local sales tax rate in Tulsa OK is 8517.

You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. Denotes Use Tax is due for sales in this city or county from out-of-state at the same rate as shown. Sales Tax in Tulsa Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

This is also in addition to the State Tax Rate of 45. In 2019 total mill rates in Tulsa County ranged from a low of about 61 mills to a high of about 132 mills. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367.

The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. The current total local sales tax rate in Tulsa OK is 8517.

Tulsa County collects on average 106 of a propertys assessed fair market value as property tax. 325 of ½ the actual purchase pricecurrent value. Tulsa County Oklahoma Property Tax Cleveland County The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of 106 of property value.

- Tax Rates can have a big impact when Comparing Cost of Living. Tulsa County Headquarters 5th floor 218 W. City Tax Rates Layout 003 CY 2021 City Tax Rates for Tulsa County Tulsa County Assessor John A.

Detailed Oklahoma state income tax rates and brackets are available on this page. 918 596-5100 Fax. The December 2020 total.

- The Income Tax Rate for Tulsa is 50. The US average is 46. Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

The countys average effective property tax rate of 113 is above both the state average of 087 and the national average of 107. 325 of 65 of ½ the actual purchase pricecurrent value. New and used all-terrain vehicles utility vehicles and off road motorcycles.

325 of taxable value which decreases by 35 annually. This is the total of state county and city sales tax rates. 4988 thus Salina is in Mayes County which has a county tax that must be added to the city tax and the State Tax.

State of Oklahoma - 45 Tulsa County - 0367 City - 365 The City has five major tax categories and collectively they provide 52 of the projected revenue. Tulsa OK 74119. A county-wide sales tax rate of 0367 is applicable.

It is 640 miles from Tulsa OK to Indianapolis IN. The Tulsa sales tax rate is. The County sales tax rate is.

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. The US average is. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The City of Tulsa imposes a lodging tax of 5 percent. Who is exempt from the tax. Whether you are already a resident or just considering moving to Tulsa to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Yearly median tax in Tulsa County. The US average is 28555 a year.

Oklahoma Sales Tax Small Business Guide Truic

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Map Of Tulsa Oklahoma Area What Is Tulsa Known For Best Hotels Home

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Pictures Download Free Images On Unsplash

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Best Assisted Living In Tulsa Ok Retirement Living

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

David L Moss Jail In Tulsa Oklahoma County Jail Tulsa Jail

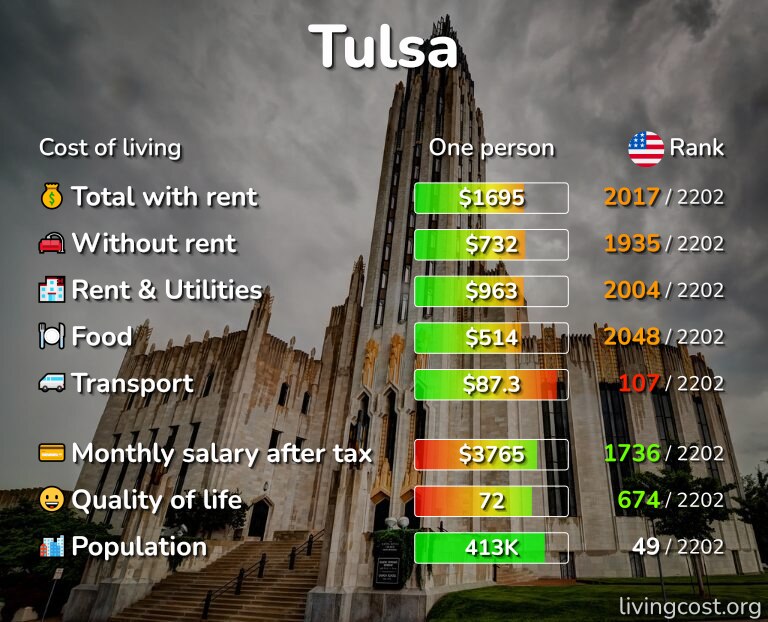

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

Scratchy Memories Of The Bill S T Records Empire Memories Tulsa Time Records